MEMBERS’ PROTECTION PROGRAM

Background: Immediately after launching the credit program in 1993, it was observed that many of the IDF members and the members of their families had been suffering from various diseases, especially in hill tracts areas. They had to spend a lot of money for their treatments to ensure its members and their family members’ well-being. In most cases they had to use money invested in their businesses or had to borrow from money lenders. This made their economic situation worse. Group members requested IDF to find solutions/ safety nets to this problem in the annual workshops of the Center chiefs at that time.

In the year 1997, an “Emergency Fund” was created with joint contributions of IDF from its surplus and nominal contributions made by the group members. The main purpose of this fund was to support the group members for meeting the costs of treatment due to illness. Later, over the years, these supports were extended to cover all members of the borrower families as well as to cover various other nature of losses like funeral costs due to deaths, damage of running project (business activity) including death of cattle. The initial attempt of covering the problem of death by forming the ‘Emergency Fund’, gradually transformed into a broad-based program named “Members’ Protection Program”.

Currently the program comprises of three components. These are:

- Health supports (treatment/medicines)

- Death (for member, spouse and dependent children below 18 years)

- Damage of on-going activity with loan money including loss/death of cattle

Contribution and coverage:

The borrower members contribute at different rates for each of the components as mentioned earlier. The rates of contribution are of course nominal. These contributions make them eligible to receive the benefits as per guidelines set for each component as described below.

Health (treatment) coverage:

The members, spouses and their dependent children below 18 years are covered under this scheme. A maximum amount of Tk. 2,000 is paid for the treatment purpose in each case. In case of severe sickness, like 15 days hospitalization in the govt. hospitals are entitled to be reimbursed. IDF medical officer examines each case before its approval.

Death coverage:

Both member and spouse or earning member in absence of spouse are covered under this scheme. In case of death of any one above, Tk. 5,000 is made available to the concerned family for funeral immediately after the receipt of the information of death by the Branch Manager. In addition, the entire outstanding loan amount on the date of death of the deceased member is written off and the amount is paid out of this fund.

Damage of project (business activity/product):

If any of the activity/product undertaken by loan money suffers from any damage and/or any loss due to genuine reasons like natural calamities, accidents, fire or any other reasons, the member gets a maximum 50% of the loan money depending on the extent of damage.

Loss/death of cattle:

For genuine reasons, if a member’s cattle, purchased with loan money, die the amount is paid to the extent of 100%.

Procedure of claims and mode of payment:

In case of any claim for sickness, death, losses of business activity and death of cattle, the concerned member informs either the respective field organizer and/or branch manager about the incident. The informed person visits and investigates the case immediately. The branch manager is authorized to pay up to Tk. 500 immediately to the concerned member if the case is for sickness (treatment), and Tk. 5,000 cash in case of death (for funeral). The remaining claims are settled after the approval of the specific case by the approving authority. It may be mentioned that the medical assistants assess the applications for claims and provides recommendations. The area manager or his/her representative disburses the claims.

Payments for Treatment:

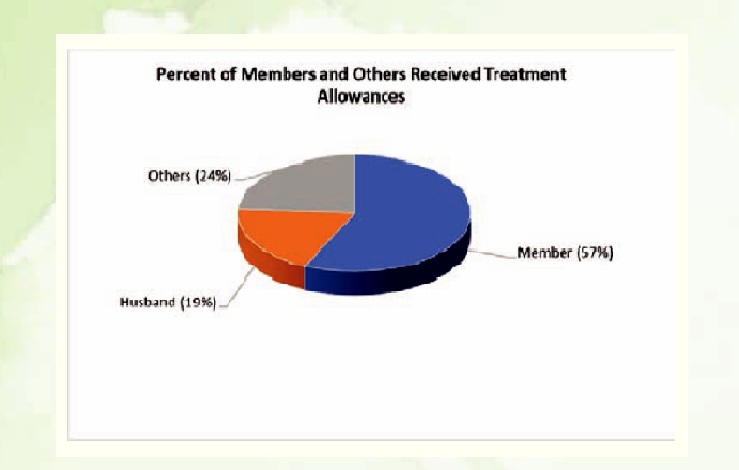

It was mentioned earlier that IDF members and the members of their families are supported against their sickness up to a maximum amount of

Tk. 2000. During the year 2020, a total of 10,738 families were supported with an amount of Tk 49, 54,642.00. Of the total recipients, more

than half 6099 (56.79%) were IDF members, 2,026 (18.87%) were their husbands, 1.365 (12.71%) were sons, 1,229 (11.45%) were daughters and 19 (0.18%) were others meaning parents, brother/- sister staying and taking food in the same Chula as special consideration.

Percent of Members and Others Received Treatment Allowances, 2020

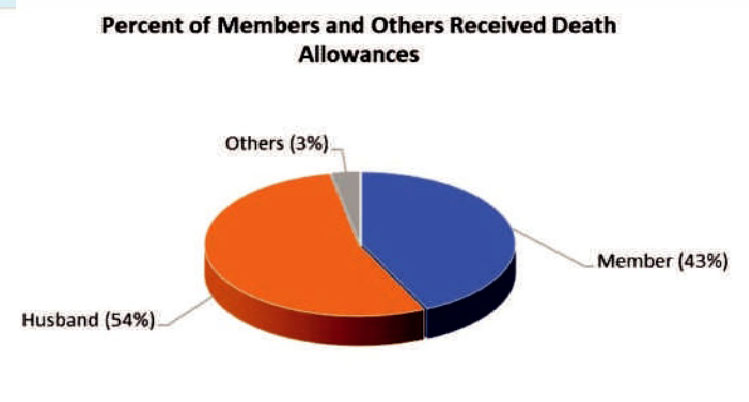

Percent of Members and Others Received Death Allowances, 2020

Payments for Deaths:

During the year 2020, payments were made for deaths of 364 people. Of them, 155 (42.58%) were IDF members, 198 (54.4%) were their husbands, 6 (1.64%) were sons and 5 (1.37%) were other members of the family. As per the arrangement, each of the deceased family was paid an amount of Tk, 5,000 for funeral. And the outstanding amount of loan of the concerned IDF member at the time of death was paid out of this fund. Thus, a total amount of Tk 12.64 million was paid as death coverage. Out of the total money, 42.6% were paid for members’ death, 54.4% for the death of husbands and for others the payment was 3.0%.

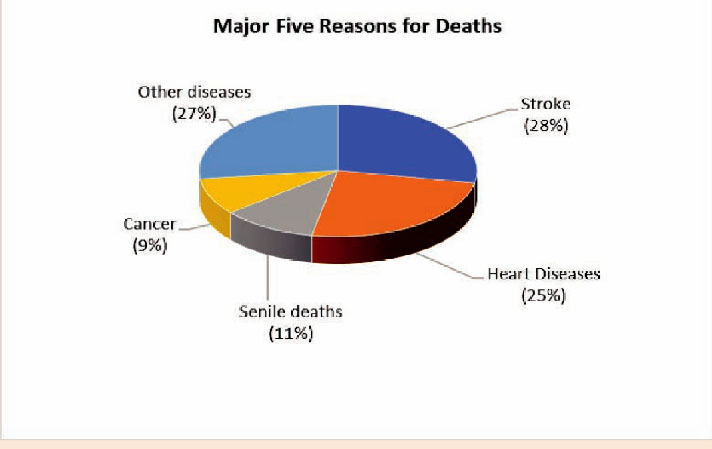

Causes of Deaths:

IDF maintained records of death and the cause of death for each deceased person. There were about 21 diseases identified by which these 364 people died. Maximum deaths were for the cause of stroke (28.0%), heart disease (25.3%), senile/natural death (10.7%), cancer (9.1%), and others. The rest of the causes and the number of persons died are provided in

Figure : Major Five Reasons for Deaths

Payments against Project Damages/ losses and Cattle Deaths:

During the year 2020, a total of 35 members claimed losses of their respective activities that they had been doing with loan money. Out of 35 members, 5 members reported that they lost their cattle due to different disease. Another 5 members lost their grocery, cloth and other businesses by fire from electric short circuit, 6 members ran into loss of their poultry farm when birds died due to ranikhet disease, 9 members’ houses got damaged due to heavy rains and the remaining members claimed different reasons. It might be mentioned here that close to about half of the affected members, 15 of 35 (42.9%), suffered losses in their businesses like shops, cloth business and house damages due to outbreak of fire. These affected members were assisted with Tk. 6, 39,297 considering the extent of damage and the amount of loan outstanding at the time of losses.

Total Amount Paid during 2020

A total amount of Tk. 18.23 million had been paid to 11,137 members as supports to the basic causes of their serious difficulties like treatments for sickness, deaths of borrowing members or their spouses and for losses in their on-going loan activities. The break-up showed supports of Tk. 4.95 million to 10,738 members for treatment, Tk. 12.64 million to 364 members for deaths and Tk. 0.64 million to 35 members for their losses in the projects of on-going loan activities.